By now “we the people” have learned that republicans in the US Congress plan to be working on their dream legislation for tax reform/ tax cuts. For me, any tax reform bill advertised as being fair, should include at least two low hanging fruit. One would be would be to have any tax breaks for home mortgages to be limited for primary homes only. The other expectation would be the elimination of the carried interest loophole.

The republican President Donald Trump frequently pledged to his supporters that he would eliminate this carried interest loophole during his numerous campaign rallies. But now that his administration’s swamp is overflowing with former Goldman Sachs investors, it is a likelihood that he will not be keeping this promise.

As per Wikipedia, “As of 2015 some in the private equity and hedge fund industries had been lobbying against changes, being among the biggest political donors on both sides of the aisle.”

Over the last decade, it is estimated that hedge fund managers have dodged nearly $180 billion in taxes.

The following commentary provides information about this carried interest loophole.

(Source: Investopedia) Fund Management Compensation and Taxation

“General partners of private equity or hedge funds are typically compensated for their fund management services in two ways. The first way is a management fee of about one or two percent of the total assets being managed. This fee is charged regardless of the funds performance and is taxed as ordinary income, the top rate being 39.6 percent.”

“The other way that the general partners are compensated is through what is known as “carried interest,” which is usually around 20 percent of profits accrued above a specified hurdle rate. Often the hurdle rate is about eight percent, and thus any returns the fund achieves above that rate means the fund’s general partners receive a 20 percent commission in addition to any profit on assets the partners have personally invested in the fund. Both the profits on personal assets and carried interest are taxed at a capital gains rate, which for high-income earners is 20 percent. (For more, see: What You Need to Know About Capital Gains and Taxes.)”

(Source: Investopedia) Carried Interest and Income Inequality

“Risk and reward aside, few argues that the carried interest loophole is innocent in the inequality blame-game.”

“Perhaps the lax taxation policy on carried interest is forgivable, considering the recent donations by large hedge fund managers to university endowment funds. Two hedge-fund managers, John Paulson and Kenneth Griffin, recently donated $400 million and $150 million, respectively, to Harvard University. Stephen Schwarzman, chair and co-founder of the private equity fund Blackstone, recently donated $150 million to Yale University. Such charitable donations that are eligible for tax credits are pledged with the stated intention of fostering higher education.”

“Yet, Victor Fleischer, a law professor at the University of San Diego, found that private equity fund managers of university endowment funds, including Yale’s, Harvard’s, the University of Texas’, Stanford’s and Princeton’s, received more in compensation for their services than students received in tuition assistance, fellowships and other academic awards. He claims that Yale paid out $343 million to private equity managers in carried interest alone while only $170 million of the university’s operating budget was aimed at assisting students.”

“With university endowment funds acting as vehicles to further enrich the wealthy at the cost of increasing student indebtedness it is hard to see how a tax break on carried interest is good economic policy. If a higher proportion of people’s income is increasingly being used to service debt rather than purchase goods and services, it doesn’t matter how much investment businesses receive. They’re not going to grow if people can’t purchase what they’re offering.”

(Source: Investopedia) The Bottom Line

“If those who perform similar services, and even take on similar risks, are required to pay the ordinary income tax rate, then general partners of private equity and hedge fund managers should pay the same rate. Considering that those on the lower end of the income and wealth spectrum tend to have higher marginal propensities to consume than their much wealthier counterparts, taxing carried interest at the ordinary income rate and using it to redistribute wealth is not just about fairness, it is good economic and social policy.”

My Thoughts

“It would be one thing if Hedge Fund Managers were dealing with their own funds in their risk taking but they are not. They are investing other peoples monies. There is this loop hole called “carried interest” where these hedge fund managers after betting with other folks funds, can earn profits (income) and then claim this income as a capital gain which is taxed at a rate of 20% while the average wage earner is burdened with a much higher tax rate.”

Those who argue against doing away with this carried interest loophole, state that general partners should be treated like entrepreneurs. If so, carried interest would then be viewed as similar to profits realized when an entrepreneur sells their business, which are generally taxed at the capital gains rate of 20%. But remember the hedge fund managers are not into the business of risking their own monies but other peoples’ monies. The average wage earner may have only ever experienced a capital gain’s tax possibility, if they have ever sold their home at a profit.

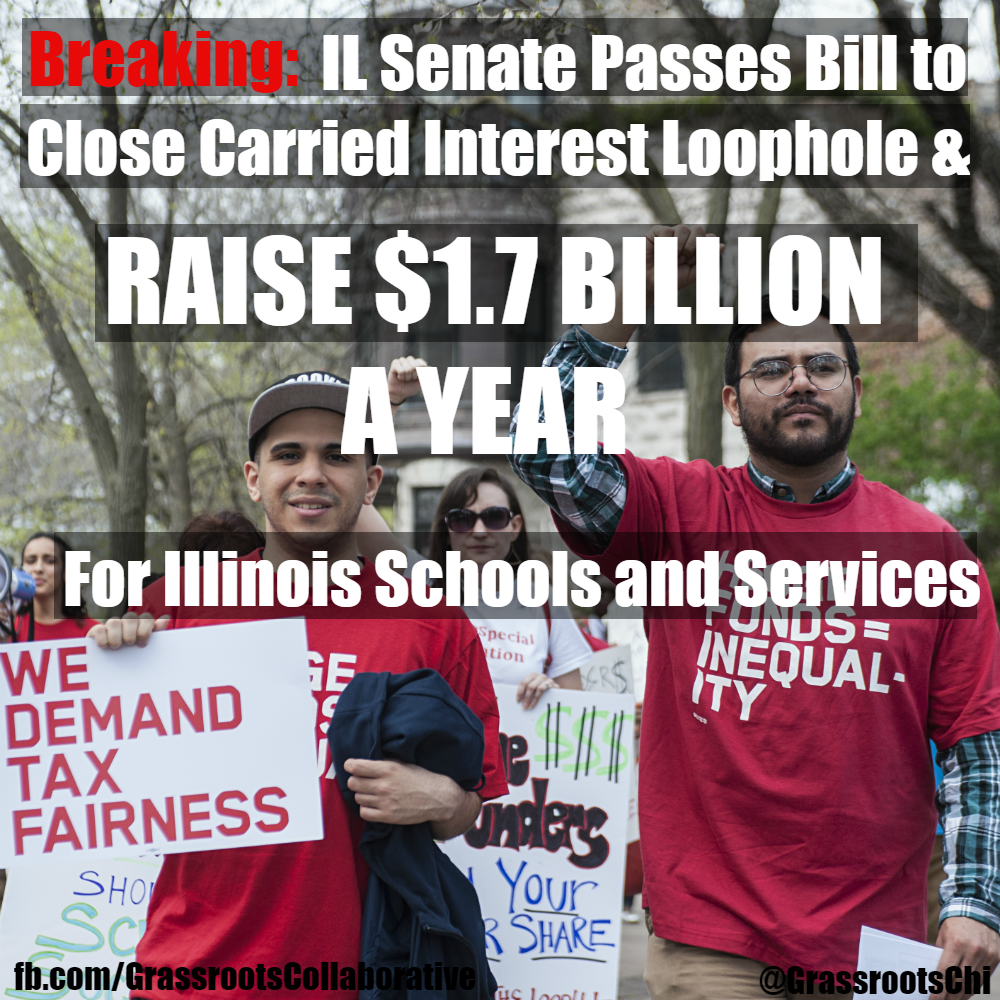

As per a 5/25/17 DailyKos report, “On May 23, the Illinois state senate became the first legislative body to pass a bill to end one of the most outrageous examples of Wall Street privilege – the so-called “carried interest” loophole. This loophole allows private equity and hedge fund managers to claim most of their earnings as capital gains rather than ordinary income, cutting their tax bill nearly in half. This means some of the wealthiest Americans pay a lower tax rate than millions of middle-income workers.”

“One of the leaders of the Illinois campaign to close the carried interest loophole is Abbie Illenberger of the Grassroots Collaborative, an alliance of 11 membership-based organizations. She explained that the issue gained momentum much more quickly than expected because of the severity of the state’s budget crisis.”

For Trump, “draining the swamp” simply meant replacing one set of leeches with another even more vicious set. I can predict only one thing regarding any ‘tax reform’ that Trump proposes, and that is, to coin an old saying, the rich will get richer while the poor will get poorer. DDT will take care of his rich friends, himself, and his rich family with zero regard for those who struggle to put food on the table every day. Hugs!!!

LikeLiked by 1 person

Dear Jill,

You are so right. DDT has simply filled his White House swamp with bigger, meaner, hungrier alligators. I hope the republicans will not try to pull a similar con on the American peoples with their tax reform bill like they did with the “skinny” republican version of a healthcare bill.

Hugs, Gronda

LikeLiked by 1 person

I agree … on the one hand, I think that since Trump’s Charlottesville response, and then his rant in Phoenix on Tuesday, Trump has lost much of his appeal to the men and women of Congress. If that is the case, enough of them may stand firm on the tax reform issue to stop him from having his way. On the other hand … sigh … members of Congress are still indebted to lobbyists and big business, the very ones who stand to gain from the tax proposal I expect to see from DDT, so it would not surprise me to see much the same scenario as we saw with the health “care” bill. Sigh. Hugs!!!

LikeLiked by 1 person