Recently, some of the billionaire class in the US have been publicly displaying apoplectic fits over comments by the freshman Democratic Party star NY Rep. Alexandra Ocasio Cortez (AOC), as she has been touting the possibility of a 70% marginal tax rate for US citizens earning an income / revenues of over $10 million dollars.

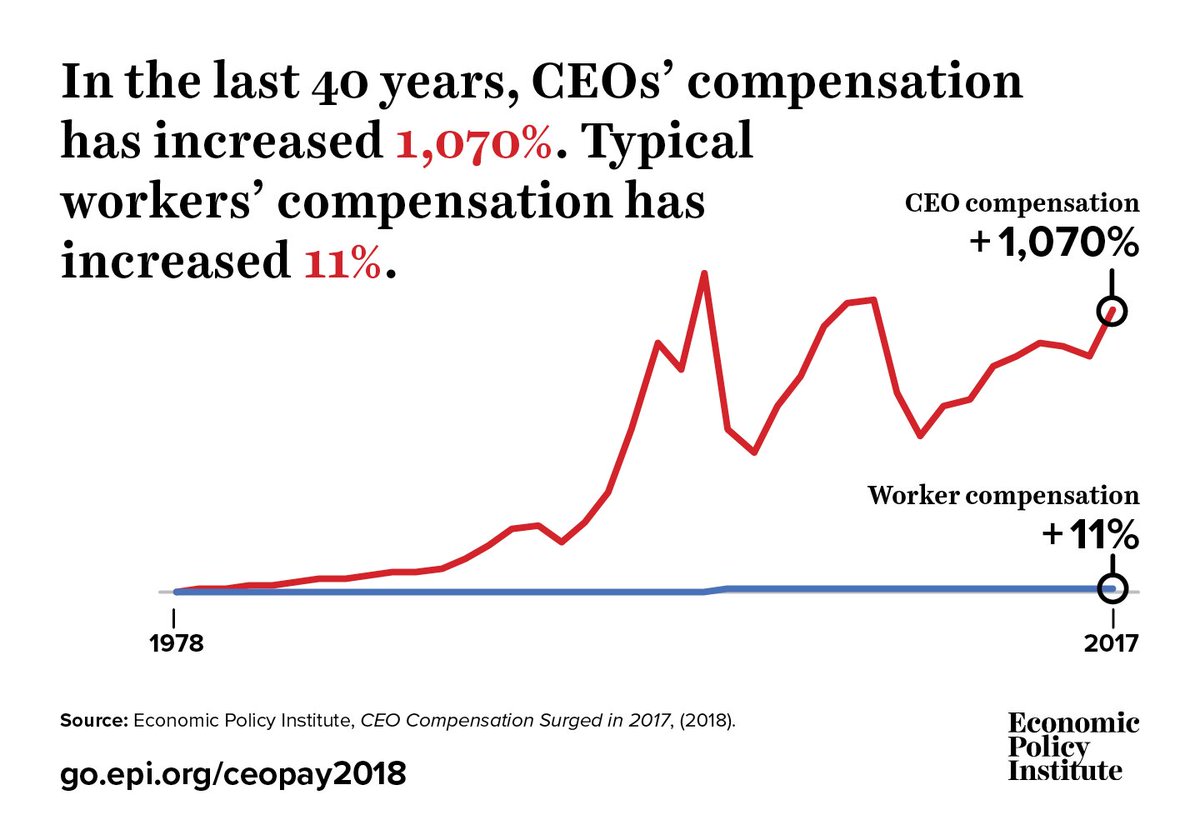

Over several past posts, based on the source, EPI (Economic Policy Institute), I’ve been detailing how US average workers fared much better from WWII to 1973 when corporations’ productivity increased by 94% but workers’ incomes rose by 91%. Post 1973, as corporate productivity increased by 77%, the average workers’ pay increased by less than 13%.

That economic inequality characterizes the American economy is not a shock to average working Americans. Study after study demonstrates that the USA has more wealth concentration than most other developed nations.

As per 10/16/17 On the Economy Blog By Federal Reserve Bank of St. Louis), “Income inequality in the U.S. is large, despite the U.S. having one of the highest levels of income per capita. Specifically, the Gini coefficient of the U.S. was 40.46 in 2010, very close to the average Gini coefficient of African countries.”

“In contrast, Nordic countries —such as Finland and Sweden—have a similar income per capita as that in the U.S., but much lower Gini coefficients.”

“The lower inequality in these countries could be explained by a tax system that redistributes income across countries and includes generous transfers like social security, health insurance and unemployment benefits. In fact, poorly designed tax systems, tax evasion and tax avoidance are part of the reason why Latin American countries have the largest Gini coefficients.”

The gap between incomes of the top 1 percent and bottom 99 percent are growing

|

State/region

|

Average income of the top 1%

|

Average income of the bottom 99%

|

|---|---|---|

| New York | $2,202,480 | $49,617 |

| Florida | $1,543,124 | $39,094 |

| Connecticut | $2,522,806 | $67,742 |

| Nevada | $1,354,780 | $41,470 |

| Wyoming | $1,900,659 | $60,922 |

| Massachusetts | $1,904,805 | $61,694 |

| California | $1,693,094 | $55,152 |

| Illinois | $1,412,024 | $52,216 |

| New Jersey | $1,581,829 | $65,068 |

| Washington | $1,383,223 | $57,100 |

| Texas | $1,343,897 | $55,614 |

| Georgia | $995,576 | $44,147 |

| Arkansas | $864,772 | $38,472 |

| Pennsylvania | $1,100,962 | $50,830 |

| Michigan | $917,701 | $42,825 |

| Tennessee | $947,021 | $44,219 |

| Missouri | $944,804 | $44,650 |

| Arizona | $882,657 | $42,000 |

| Minnesota | $1,185,581 | $56,728 |

| Colorado | $1,261,053 | $61,165 |

| North Carolina | $902,972 | $43,850 |

| South Dakota | $1,130,048 | $56,610 |

| Oregon | $908,898 | $46,090 |

| Utah | $1,057,066 | $53,614 |

| South Carolina | $761,185 | $38,646 |

| Alabama | $743,644 | $38,587 |

| Montana | $855,976 | $45,197 |

| Wisconsin | $964,358 | $50,953 |

| Ohio | $858,965 | $46,157 |

| Kentucky | $719,012 | $38,990 |

| Kansas | $1,034,676 | $56,628 |

| Rhode Island | $928,204 | $50,963 |

| Louisiana | $814,386 | $45,060 |

| New Hampshire | $1,134,101 | $62,796 |

| Maryland | $1,135,718 | $63,656 |

| Oklahoma | $932,520 | $52,533 |

| Virginia | $1,109,984 | $62,844 |

| Idaho | $829,268 | $47,727 |

| Indiana | $804,275 | $46,501 |

| Delaware | $869,461 | $51,049 |

| Mississippi | $580,461 | $35,353 |

| Nebraska | $945,869 | $58,013 |

| Vermont | $816,579 | $50,283 |

| North Dakota | $1,080,845 | $68,316 |

| New Mexico | $615,082 | $39,675 |

| Maine | $655,870 | $42,575 |

| West Virginia | $535,648 | $34,987 |

| Iowa | $788,419 | $53,753 |

| Hawaii | $797,001 | $57,987 |

| Alaska | $910,059 | $71,876 |

| District of Columbia | $1,858,878 | $61,102 |

/cdn.vox-cdn.com/uploads/chorus_asset/file/6521457/13.png)

See: How To Fix Stagnant Wages: Dump The World’s Dumbest Idea – Forbes

See: Why Wages Aren’t Growing in America – Harvard Business Review/ 2017

See: For most Americans, real wages have barely budged for decades/ Pew Research

See: The Long-Term Jobs Killer Is Not China. It’s Automation. – The NYT/ 2016

These entitled rich folks are acting as if this high a marginal tax rate is unheard in US history.

As per the 11/15/15 Politifact report, “Let’s review what the marginal tax rate means. It’s the tax rate that’s applied to the last dollar earned. The U.S. tax system is based on brackets. The top marginal tax rate applies to the highest bracket. Income is taxed at higher rates as more is earned.”

“We turned to the Tax Foundation’s federal income tax rates history, which documents figures going all the way back to 1913, when the income tax began with the ratification of the 16th Amendment.”

“During the eight years of the Eisenhower presidency, from 1953 to 1961, the top marginal rate was 91 percent. (It was 92 percent the year he came into office.)”

/cdn.vox-cdn.com/uploads/chorus_asset/file/6521455/12.png)

“What does it mean, though? For the duration of Eisenhower’s presidency, that rate affected individuals making $200,000 or more per year or couples making $400,000 and above per year.”

“In 2015 dollars, that’s roughly $1.7 million for an individual and $3.4 million for a couple.”

“The tax brackets are adjusted for inflation, but are exceptionally lower than in Eisenhower’s day. The top rate in 2015 is 39.6 percent, applied to single people making $413,200 or more per year, or married couples filing jointly making $464,850 or more annually. If we went back to 1954, single people making the equivalent of $413,200 would be in a 72 percent tax bracket, while a couple making $464,850 would end up in a 75 percent bracket.”

“What’s the highest income tax bracket ever put in place? In 1944-45, during World War II, couples making more than $200,000 faced an all-time high of 94 percent.”

In short, the top marginal tax rate applies to the highest bracket. Income is taxed at higher rates as more is earned. Those wealthy individuals who are showing signs of panic need to know that in comparison to past years when income inequality was less of an issue, it can be said that the plan as advertised by AOC to impose a marginal tax rate of 70% on income over 10 million dollars, is a bargain.

As per TPC Tax Policy Center data as of 18th of January 2019:

/cdn.vox-cdn.com/uploads/chorus_image/image/62786093/1076675010.jpg.0.jpg)

On January 7, 2019, Matthew Yglesias of VOX penned the following report, “Alexandria Ocasio-Cortez is floating a 70 percent top tax tate- here’s the research that backs her up”

“Some studies indicate she’s aiming too low.”

Excerpts:

“In an interview that aired Sunday on 60 Minutes, America’s most widely covered new House member Alexandria Ocasio-Cortez (D-NY) floated the idea of a top marginal income tax rate as high as 70 percent as part of a plan to finance a “Green New Deal” that would aim to drastically curb America’s carbon dioxide emissions.”

“Seventy percent is a lot higher than the current rate and will doubtless fuel the conservative effort to paint AOC as a know-nothing, but the number is in line with one prominent strain of recent economics research and is at least moderately well supported by America’s historical experience.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/6524055/10.0.png)

Top tax rates used to be much higher

“Historically, the US used to have many more tax brackets, and the top marginal tax rates were extremely high. Under Eisenhower, the top earners paid a 91 percent marginal rate, falling to Ocasio-Cortez’s proposed 70 percent under Kennedy and Johnson, before falling to 50 percent after Ronald Reagan’s first big tax cut, and then down to 38 percent after the 1986 tax reform.”

“One big part of that story is that before 1986 the tax base was considerably narrower. Rich people used to have a lot more loopholes and deductions of which they could avail themselves. The 1986 law closed a lot of those loopholes, but also cut the top rate.”

“But another part of the story is that there used to be more tax brackets. Right now a single person earning $550,000 a year pays the same marginal rate as a person earning 10 or 50 times as much. Under the old tax code, the top rate was reserved its top rate for the super-duper rich.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/6524057/11.0.png)

“Ocasio-Cortez seems to have something like this in mind when she tells Cooper, “Once you get to the tippy-tops, on your $10 millionth dollar, sometimes you see tax rates as high as 60 percent or 70 percent. That doesn’t mean all $10 million dollars are taxed at an extremely high rate. But it means that as you climb up this ladder, you should be contributing more.”

“In other words, she’s not saying that everyone who pays the current top rate should see their taxes raised to 60 or 70 percent. Rather, a small number of ultra-rich people should pay at that rate. This is obviously a controversial proposition that will strike some as unfair and others as counterproductive to the economy. But it’s pretty much in line with the cutting-edge work of progressive-minded tax economists.”

Link to entire report: vox.com

See: How past income tax rate cuts on the wealthy affected the economy Politico/ 2017

[…] via NY Rep. AOC Knows More About US Top Tax Marginal Income Tax Rates Than Her Detractors […]

LikeLiked by 1 person

Dear Sotomayor,

Income inequality is one of the top issues that democratic legislators need to address. Business leaders could become part of the solution unless they want to see headlines like in France where the country is awash in protests. The American public needs to better educated regarding this issue so that they are not vulnerable to con men politicians wanting them to blame others (fill in the blank) for their economic morass.

The other top issues in my mind are addressing climate change problems head on as well as bolstering US voting rights, delivering on sensible gun control measures.

Thanks a million for all of your support and for this reblog.

Hugs, Gronda

LikeLike

Disgusting! How the Sam Heck did we go from a top rate of 90%+ to under 40%??? Politics. Says the rich man to the candidate for public office: “I’ll scratch your back if you’ll scratch mine. I’ll support you and make mega-donations to your campaign, as long as you vote in such a manner as to keep my tax rates low, remove regulations that cost me money, and keep the minimum wage I pay my workers low.” Greed. And they further add insult to injury by wanting to cut “social welfare” programs that help those earning the least to feed their children, have a place to live, and be able to seek medical care when needed. I’ve said it before, but I would love to see a nationwide worker’s strike for one month to wake up these greedy bastards in the top 10%. Sigh. We reward the most corrupt and greedy and penalize those who are doing the heavy lifting while their bosses enjoy a hedonistic lifestyle. Excellent post, Gronda … thank you for so much fact-based information.

Hugs.

LikeLiked by 1 person

Dear Jill,

There has been so much discussion about the rise of populism in the US as well as in other developed countries because of this income inequality which does need to be addressed.

One of the main contributions to this income inequality gap is that of the unfair US taxation model. The other is the formation of corporate entities like ALEC in 1973 which has pushed for the decline of company unions and its pension programs. Then there are market forces; advancement of technology which have cost the average day worker, bigly.

The Dems need to educate American voters better so that they won’t buy the argument from ne’re do well politicians that their economic woes are due to the other (immigrants as per President Trump).

Hugs, Gronda

LikeLiked by 1 person

Reblogged this on It Is What It Is and commented:

For the economy oriented folks … #AOC … she knows her stuff!!

Stop by and take a look!!

LikeLiked by 1 person

Dear Horty,

I’m loving this AOC Alexandria Ocasio-Cortez more and more as she brings up topics that others would prefer to ignore. When pundits got on the band wagon to thrash her economic policy ideas, they didn’t even know what she was talking about.

She ended up embarrassing the lot of them. Thanks a million times over for all of your support and for this reblog.

Hugs, Gronda

LikeLike

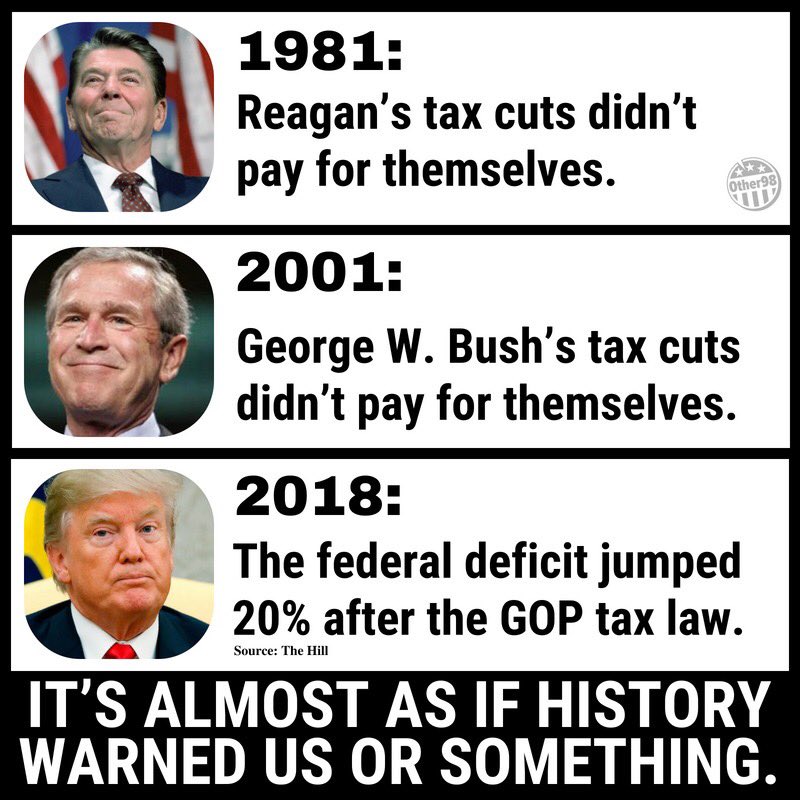

The country is going broke, we are creating more and more programs, yet we are taxing less and less. This is a recipe for disaster and needs to be addressed.

LikeLiked by 1 person

Dear August Jensen,

The country is not being fiscally managed well. We all know that we need government but we want it to be limited, with lots of accountability to insure monies are being spent wisely. The GOP party likes to think of themselves in this light but they have proven to be less than good stewards of our economy.

The president’s recent 2019 35 day government shutdown is a case in point. It cost the US taxpayers $26 billion dollars. Then there is the 2017 GOP tax plan which will cost US taxpayers over 2 trillion dollars over 10 years.

There comes a time when we can no longer listen to their no tax increase mantra.

Hugs, Gronda

LikeLike

I agree, the GOP has long heralded themselves as the fiscally Conservative party, but when they had control of the executive branch and both houses of Congress, what did they do? Cut taxes (revenue) and started spending more money, bringing our deficit back up to a trillion dollars. Enough is enough future generations are going to end up paying the price for this.

LikeLiked by 1 person