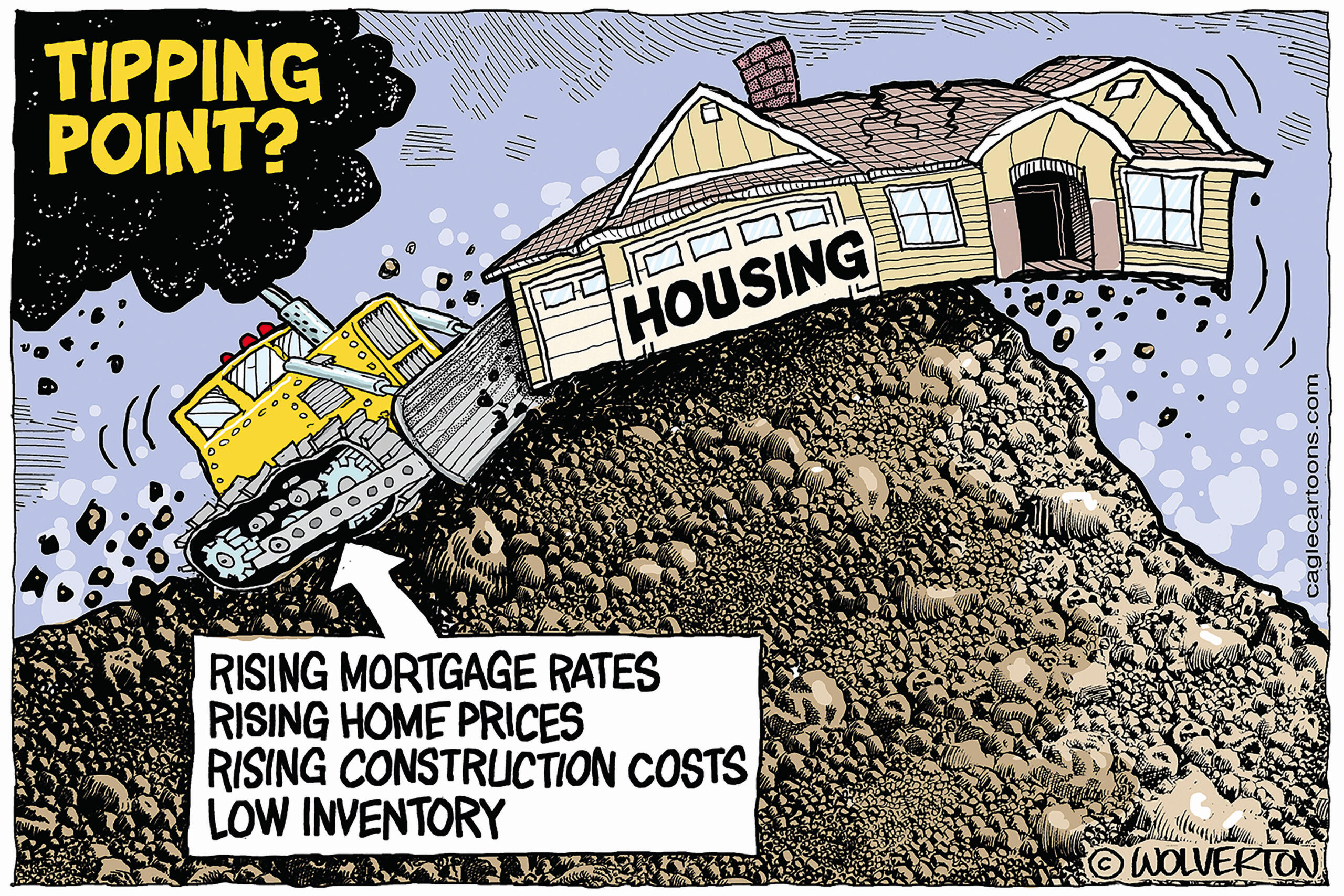

On the 2024 US presidential campaign trail the democrat party’s presidential nominee Vice President Kamala Harris has been sharing her plans to assist average folks in the purchase of a home due to a shortage of available affordable homes for individual families. She’s committed to working with businesses to build 3 million homes in her term to increase the supply of reasonably priced homes for sale. In addition, she’s proposed giving the first-time home buyer $25,000 dollars to use as a down payment. She’s also pledging to take on corporate landlords and to cap unfair rental price increases. She’s endorsed the ending of tax breaks for corporate entities which own more than 50 homes as rental properties. as part of her affordable housing plan.

On the 2024 US presidential campaign trail the democrat party’s presidential nominee Vice President Kamala Harris has been sharing her plans to assist average folks in the purchase of a home due to a shortage of available affordable homes for individual families. She’s committed to working with businesses to build 3 million homes in her term to increase the supply of reasonably priced homes for sale. In addition, she’s proposed giving the first-time home buyer $25,000 dollars to use as a down payment. She’s also pledging to take on corporate landlords and to cap unfair rental price increases. She’s endorsed the ending of tax breaks for corporate entities which own more than 50 homes as rental properties. as part of her affordable housing plan.

If readers click Google and the subject of LLCs purchasing homes, they’ll see pages upon pages with instructions for buyers on how to manage rental properties by becoming an LLC business.

In the Tampa Bay area where I live, LLCs have purchased 27,000 homes, 70% are backed by institutional investors like Wall Street and Equity firms. This circumstance of corporations buying homes for rental income has spread throughout the USA, causing a supply shortage which drives up home prices for individual buyers and allows for huge rental price increases which makes it a catalyst for rising inflation issues.

For Florida and other states experiencing extreme weather events due to climate change, there’s the added nightmare of recent huge premium increases on property insurance, if it’s even available. The increase in property insurance premiums also makes it more difficult for individuals to purchase a family home as the monthly mortgage payments require that homeowners’ insurance be included in the monthly payments.

Another factor that I’ll cover in a future blog is that consumers are being denied extra monies related to home ownership because US states like Florida governed by a GOP MAGA leader have been refusing to take monies from federal government provided for via the recent Inflation Reduction Act to help owners update property structures to mitigate against extreme weather conditions. In 2023 Florida’s Governor Ron DeSantis vetoed a request by the GOP-dominated state legislature to establish a $5 million rebate program—a program that was essential to accessing $346 million more.

The Tampa Bay Times did a great analysis on this subject LLCs buying homes…

As per a September 3, 2024 Tampa Bay Times report by Rebecca Liebson and Teghan Simonton, “Florida lawmakers stay quiet as corporations buy thousands of Homes, LLC corporations have been buying into the Florida homeowner market causing a shortage of available homes for purchase by individuals and rental rate hikes which also adds to consumers’ inflation complaints. In the Tampa Bay area alone, LLCs have purchased 27,000 homes, 70% are backed by institutional investors like Wall Street and Equity firms.

Excerpts:

“As investor-backed firms buy up homes across the country, policymakers at every level are considering how to limit Wall Street’s control of the housing market.”

“In Congress, Democrats have proposed a bill that would require hedge funds to sell off single-family homes over the next decade.”

“In Minnesota, a state representative tried to restrict the number of homes an individual or company could own.”

“At a rally in Atlanta, Vice President Kamala Harris pledged to “take on corporate landlords and cap unfair rent increases.”

“Even in Florida, a state friendly to corporations and landlords and at times hostile to renters, one Republican state lawmaker said it may be time for government intervention.”

“Hedge funds shouldn’t be in this business,” said Sen. Jeff Merkley, D-Ore., who is pushing for federal regulation. “They’re driving up prices in places like Florida where there’s already extra hurdles to homeownership.”

“Experts blame several factors, including the sharply divided Congress and lobbyists who give investors the upper hand over tenants, who don’t have the deep pockets to pay for legislative representation.”

“Corporate investments in housing have risen across the country. The Tampa Bay Times earlier analyzed property data from across the state for a first-of-its-kind examination of the trend in Florida, one of the most popular destinations for the companies. The Times found more than 117,000 investor-owned homes across the state. The vast majority are linked to Wall Street and private equity-backed firms.”

“The companies say they provide housing for those who can’t afford to buy themselves. But some renters and neighbors have criticized the companies for poorly maintaining properties, gentrifying Black neighborhoods and hastily filing evictions in a way that emphasizes profits over the rights of renters.”

“These corporations don’t have any respect for the tenant,” said Letitia Harmon, policy and research director for the progressive advocacy group, Florida Rising. “They’re opposed to regulation because they don’t want to actually have to invest in a safe, habitable property.”

“To plug a void in reforms that address this market trend, some Tampa Bay leaders say they are taking steps to keep real estate in the hands of individuals and families. A growing number of homeowners associations are finding creative ways to keep corporations out of their neighborhoods.”

The push to ban investment properties

“Large investors — companies with 1,000 homes or more — own about 3% of U.S. housing stock, according to data from the consulting firm John Burns. They are active mostly in Sun Belt cities with rapidly rising rents and strong population growth. This includes Jacksonville, Orlando and Tampa Bay, where earlier this year the Times found about 20,000 corporate-owned homes.”

“U.S. Rep. Adam Smith, D-Washington is sponsoring federal legislation with Merkley to ban large corporations from buying single-family homes. The End Hedge Fund Control of American Homes Act would require investors to sell off their portfolios over 10 years and impose a hefty tax on corporate-owned homes during that grace period.”

“Merkley told the Times that he’s been trying to call out private equity investments in the housing market for more than a decade. He noticed when Wall Street-backed firms started buying up single-family homes following the 2008 housing crash.”

“At that time, investors’ deliberate efforts to obscure their purchases made it hard to quantify the problem. But Merkley said recent reporting from the Times and others has brought attention to the issue.”

“Another federal bill called the Stop Predatory Investing Act would eliminate tax benefits for investors with 50 or more homes. Vice President Harris just endorsed that measure as part of her affordable housing plan.”

“Similar legislation has been proposed in statehouses from California to Ohio. Florida State Rep. Berny Jacques, R-Seminole, told the Times he is exploring legislative options to regulate single-family rentals in the Sunshine State.”

“The issue is one that resonates with voters on both sides of the aisle, said Smith. It’s not a question of red versus blue, but of the little guy versus Wall Street.”

“The one place where your average working-class family that doesn’t own a million shares of Microsoft or SpaceX or whatever gets wealth is from their home,” he said. “Now Wall Street has noticed that and said, ‘We want that, too.’”

“Still, no state or federal law has come close to passing.”

“Merkley attributes the lack of movement on this issue to the power of special interest groups like the National Rental Home Council, which represents some of the biggest corporate landlords in the industry.”

“In Florida, any bill that singles out large investors would be seen as “socialist,” said Jeff Brandes, a former Republican state senator who represented St. Petersburg. He now runs the Florida Policy project, a think tank focused in-part on tackling the state’s affordable housing crisis.”

“Taxing corporate landlords at a higher rate would require a change in the state’s constitution, a tough political hurdle to overcome.”

“It’s not something I think the Legislature is going to address nor should they,” Brandes said. “Cities and counties and the state need to be focused on building more housing. … Everything else is a tertiary issue.”

“Those companies have played a huge part in the escalation of the cost of housing and also the cost of rent,” said Tampa Mayor Jane Castor. “You don’t want gentrification in any neighborhood. ”

“When it comes to placing limits on these corporations, city and county officials said their hands are tied.”

“Under Gov. Ron DeSantis, the power to set housing policy has become increasingly concentrated at the state level. The passage of the Florida Landlord Tenant Act in (2023) effectively nullified all county and city level renter protections. The Live Local Act, which provided incentives for developers to build affordable housing, also banned municipalities from enacting rent controls.”

“St. Petersburg City Council Member Richie Floyd, who has been a vocal critic of profit-driven landlords, said the state’s history of preemption means there is little that local lawmakers can do.”

“It’s not impossible,” he said. “But it would be a very tricky needle to thread. And as we’ve seen in the past, the state comes in and stops us the next legislative session.”

Other Tampa Bay Times articles:

How corporate investors are taking over Tampa Bay neighborhoods

Florida homes owned by corporate investors: 117,000 -and counting

Tampa Bay’s rent rising faster than any other metro area this year

[…] LLCs Purchasing Homes as Rental Properties Leads to Housing Shortages and Rental Price Increases […]

LikeLiked by 1 person

Hi Ned,

Thanks a million for reblogging this post. I live in Tampa where homes have become unaffordable because of these LLCs, and the huge increases in property insurance premiums.

Hugs, Gronda

LikeLike