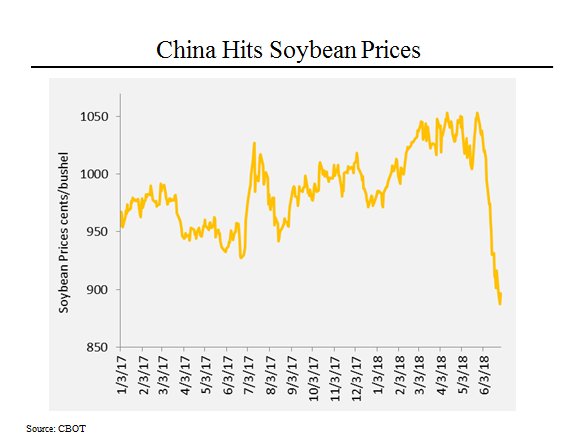

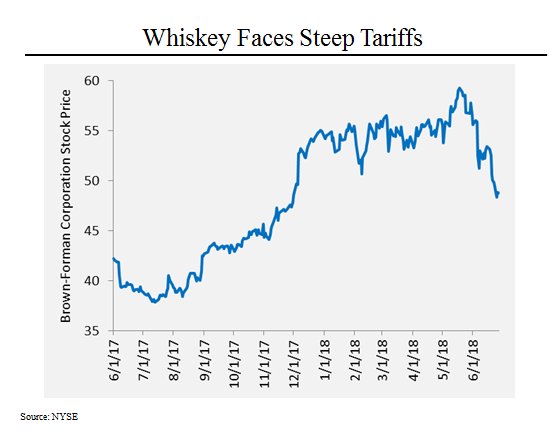

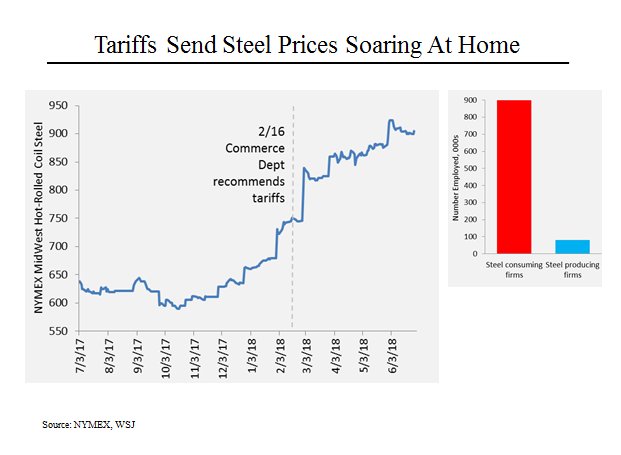

In the past 6 months, the republican President Donald Trump and his fellow GOP members in the US Congress have passed a major tax cuts bill which was paid for in part by adding $1.5 trillion dollars to the US deficit over 10 years and a major spending bill of $1.8 trillion dollars. The president has started charging tariffs to even our neighbors and allies which will end up being a drag on the economy as per the vast majority of economists.

See: Congress Passes $1.8 Trillion Spending Measure – The New York Times

See: There’s a Surprise in the Government Funding Bill: More Tax Cuts/ NYT

See: 4 winners and 4 losers from the GOP tax bill – Vox

See: Republican tax cuts to fuel historic U.S. deficits: CBO | Reuters

What could possibly go wrong? How about careening out of control US debt levels?

Here’s the rest of the story…

On June 26, 2018, Benji Sarlin of NBC News penned the following news, “CBO: Ballooning national debt could hurt U.S. economy, increase likelihood of crisis”

“The national debt is on track to nearly double as a share of the economy over the next 30 years, according to a new report from the nonpartisan Congressional Budget Office.”

“Federal debt is currently equivalent to 78 percent of the country’s annual Gross Domestic Product, with the report estimating it will rise to 100 percent of GDP by 2030 and 152 percent by 2048. The share of debt would surpass records set in the World War II era.”

“The annual long-term budget outlook lists rising health care costs and entitlement spending to account for aging Baby Boomers as the primary culprit. Discretionary spending, by contrast, is expected to remain steady and even shrink in coming years.”

“Economists are split over how concerning long-term debt projections should be for policymakers and how best to resolve them, but the Congressional Budget Office made clear in its report that ongoing deficits have the potential to create problems down the line.”

“Large and growing federal debt over the coming decades would hurt the economy and constrain future budget policy,” the report reads. “The amount of debt that is projected under the extended baseline would reduce national saving and income in the long term; increase the government’s interest costs, putting more pressure on the rest of the budget; limit lawmakers’ ability to respond to unforeseen events; and increase the likelihood of a fiscal crisis.”

“Trump’s thinking on the deficit has been inconsistent.”

“His administration helped broker a legislative agreement that will increase both military and domestic spending, but Trump threatened to veto the bill before signing it and has since demanded that it be scaled back.”

Reblogged this on Musings on Life & Experience and commented:

Things aren’t looking good.

LikeLiked by 1 person

Dear Suzanne,

Times are about to get rough. Wait a minute, they are already rough.

Thanks a million times for all of your support and for this reblog.

Hugs, Gronda

LikeLike

🙂

LikeLike

Gronda, we are borrowing from our future to make the second longest growth period in out country’s history at 107 consecutive months a little better. The debt was projected to increase from $21 trillion to $31 trillion without the tax change by 2027. Now, we are looking at $33 trillion plus. This is beyond poor stewardship. It is malfeasance. Keith

LikeLiked by 1 person

Dear Keith,

President Trump and his republican sycophants have taken a great economy with real potential and have dug us a hole that will take years to fix.

If they were CEOs of a corporation, they would all get fired.

Hugs Gronda

LikeLike

Gronda, agreed. Additionally, they took a lever off the table in tax cuts should the economy need a jump down the road. We can no longer afford any more cuts and could not afford this one. Keith

LikeLiked by 1 person